New BEAD Rules: A Win for Wireless?

The U.S. Department of Commerce’s recent Broadband Equity, Access, and Deployment (BEAD) Program Restructuring Policy Notice, announced on June 6, 2025, marks a significant shift in the approach to distributing $42.45 billion in funding aimed at achieving universal high-speed broadband access across the United States. Administered by the National Telecommunications and Information Administration (NTIA), the BEAD Program has been restructured to prioritize a “technology neutral” and “lowest-cost possible” approach, potentially opening the door for wireless technologies like Fixed Wireless Access (FWA) and Low Earth Orbit (LEO) satellite services to compete more effectively for funding. This policy overhaul could be a game-changer for the wireless industry, which has long faced challenges in securing a significant share of federal broadband funds compared to wireline (fiber) providers.

Background: The Fiber Bias in BEAD

Under the previous administration, the BEAD Program, established by the Infrastructure Investment and Jobs Act (IIJA) of 2021, imposed requirements that industry observers widely perceived as favoring fiber-optic deployments. The original Notice of Funding Opportunity (NOFO), published on May 12, 2022, prioritized end-to-end fiber as the standard for “Priority Broadband Projects,” relegating other technologies like FWA and LEO satellites to a lower-tier status. This structure limited the ability of wireless providers to compete, as fiber was seen as the gold standard for reliability and scalability, despite its high deployment costs, particularly in rural and remote areas.

Several factors contributed to this apparent fiber bias. The NOFO included non-statutory requirements, such as labor, employment, and workforce development mandates, climate change resilience criteria, and open access/net neutrality provisions, which increased costs and complexity for applicants. These requirements often aligned more closely with the operational models of well-funded fiber providers, who could absorb the costs of compliance, including the 25% matching investment requirement. Additionally, the influence of experienced lobbying teams representing wireline interests likely played a role in shaping the program’s initial framework, further sidelining wireless technologies.

As a result, no broadband deployment projects had broken ground since the IIJA’s passage in 2021, leaving many unserved and underserved communities without access. Critics, including lawmakers, state officials, and industry groups, argued that these burdensome regulations stifled competition, deterred provider participation, and failed to deliver the “Benefit of the Bargain” promised to American taxpayers.

The New BEAD Rules: A Technology-Neutral Approach

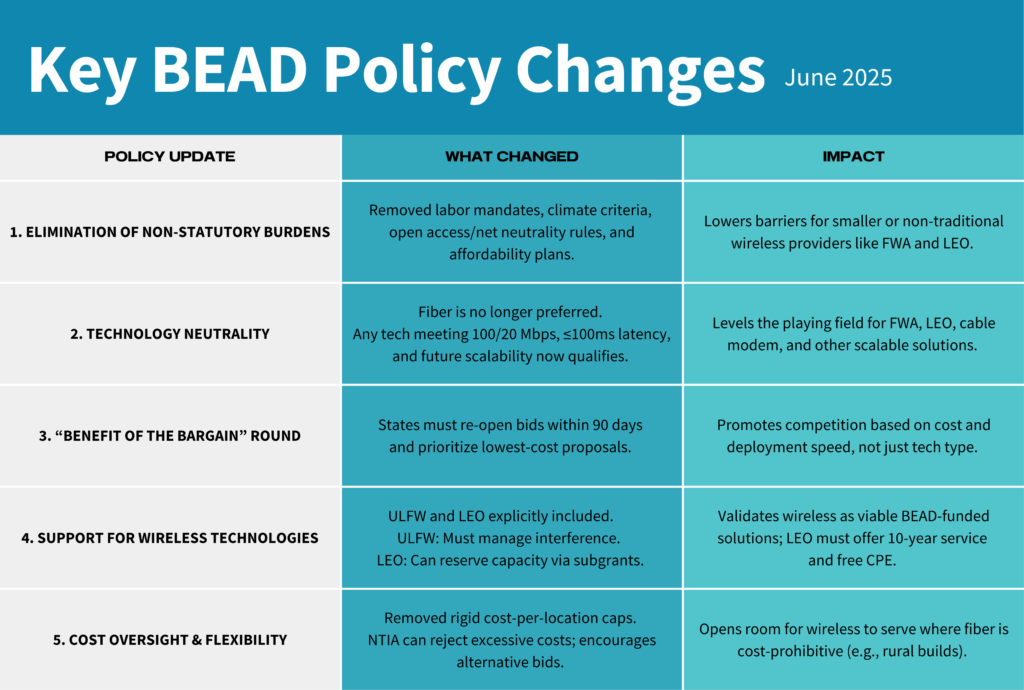

The June 2025 Policy Notice introduces sweeping changes to address these issues, emphasizing rapid deployment, cost efficiency, and technological inclusivity. Key changes include:

- Elimination of Non-Statutory Burdens: The NTIA has removed several requirements from the original NOFO, including labor and workforce development mandates, climate change resilience criteria, open access/net neutrality provisions, and the middle-class affordability plan. These changes reduce the financial and administrative barriers that disproportionately affected smaller or non-traditional providers, such as those offering FWA or LEO services.

- Technology Neutrality: The Policy Notice eliminates the NOFO’s fiber preference, redefining “Priority Broadband Projects” to include any technology that meets the statutory performance criteria of 100 Mbps download, 20 Mbps upload, and latency of 100 milliseconds or less, while also being scalable to support future needs like 5G and advanced services. This opens the door for FWA, LEO satellite services, cable modem/hybrid fiber-coaxial, and other technologies to compete on equal footing with fiber, provided they meet these standards.

- Benefit of the Bargain Round: To ensure fair competition, the NTIA mandates an additional subgrantee selection round, termed the “Benefit of the Bargain Round,” within 90 days of the Policy Notice. This round requires Eligible Entities (states, territories, and the District of Columbia) to rescind preliminary subaward selections and allow all providers, regardless of technology, to submit or revise applications. The selection process now prioritizes the lowest-cost proposals, with secondary criteria like speed to deployment and technical capabilities only considered when proposals are within 15% of the lowest-cost option on a per-location basis.

- Support for Wireless Technologies: The Policy Notice explicitly supports the inclusion of unlicensed fixed wireless (ULFW) and LEO satellite services. Appendix A outlines technical requirements for ULFW providers to mitigate interference and ensure capacity, such as beamforming, reserved base station capacity, and adherence to manufacturer best practices. Appendix B introduces ‘LEO Capacity Subgrants,’ which let LEO providers reserve capacity for BEAD-funded areas without requiring a federal interest in physical infrastructure, addressing the unique nature of satellite deployments. LEO subgrantees must provide consumer premises equipment (CPE) at no cost for standard installations and maintain service availability for a 10-year period of performance.

- Cost Oversight and Flexibility: The NTIA has eliminated the requirement for Eligible Entities to set an extremely high cost per-location threshold, instead reserving the right to reject projects deemed excessively costly. This change aims to prevent scenarios like Nevada’s $200,000 per-location threshold, which led to inefficient use of taxpayer funds. Excluding high-cost locations from project areas and soliciting alternative bids enables wireless solutions to compete in areas where fiber deployment is economically unviable.

Implications for the Wireless Industry

These changes represent a significant opportunity for the wireless industry. By removing the fiber-centric bias and emphasizing cost efficiency, the NTIA has created a more level playing field. FWA and LEO technologies, which are often faster and less expensive to deploy in rural or topographically challenging areas, can now compete effectively for BEAD funding. For example:

- Fixed Wireless Access (FWA): FWA is well-suited for areas with low population density or difficult terrain, where laying fiber is prohibitively expensive. The Policy Notice’s inclusion of ULFW, with specific technical requirements to ensure reliability, allows providers to leverage existing infrastructure or deploy new networks quickly. The ability to exclude high-cost locations from project areas further enhances FWA’s competitiveness, as providers can target areas where their technology offers the most cost-effective solution.

- Low Earth Orbit (LEO) Satellites: LEO services, such as those provided by companies like Starlink, offer a viable solution for remote areas where terrestrial infrastructure is impractical. The introduction of LEO Capacity Subgrants, with flexible reimbursement models and reduced administrative burdens (e.g., no federal interest in equipment), incentivizes LEO providers to participate. The requirement to provide free CPE for new subscribers further lowers barriers to its adoption, making LEO a compelling option for underserved communities.

The explicit mention of supporting “the deployment of 5G and successor wireless technologies” signals the NTIA’s recognition of wireless as a critical component of future-proof broadband infrastructure. This aligns with the program’s goal of ensuring scalability to meet evolving connectivity needs, positioning wireless providers in a pivotal role of closing the digital divide.

Challenges and Considerations

While the Policy Notice is a gain for wireless providers, challenges remain. Eligible Entities must navigate the complexities of re-running subgrantee selection processes within a tight 90-day timeline, which could strain administrative resources. The requirement to verify existing ULFW services to prevent overbuilding adds another difficulty, as does the need to align Community Anchor Institution (CAI) designations with a narrower statutory definition. Additionally, while the Policy Notice reduces regulatory burdens, wireless providers must still meet stringent technical and financial qualifications, including demonstrating scalability and compliance with federal labor laws through self-certification.

Some uncertainty is introduced by the NTIA’s reservation of the right to reject projects deemed excessively costly or improperly classified as Priority Broadband Project. Wireless providers will need to present robust documentation to prove their technologies meet performance and scalability requirements, particularly for ULFW, which must address interference concerns.

How Ambiflo Can Help

Ambiflo empowers telecom stakeholders with its innovative Digitized Development System, integrating Situational Awareness, Data Science, and Immersive 3D Digital Twins to revolutionize network planning and deployment. By leveraging actionable insights from data science, Ambiflo analyzes coverage gaps, population density, and geographic features to optimize site selection and forecast performance outcomes, enabling smarter decision-making. The company employs cutting-edge technologies like drones, 3D scanning, and digital mapping to create detailed Digital Twins, facilitating precision planning and reducing on-site visits. Through end-to-end digitized workflows, Ambiflo streamlines site acquisition, design, construction, integration, and acceptance, cutting planning time by up to 60%, enhancing operational efficiency, and boosting asset ROI by identifying nearby customer opportunities. This comprehensive approach supports Mobile Network Operators, Tower Companies, OEMs & Vendors, and Construction & Engineering Firms in shortening deployment timelines and maximizing resource utilization.

Fear Not, Fiber. There Is Plenty to Go Around

Despite the recent shift toward a technology-neutral approach in the BEAD Program, wireline and fiber deployments remain well-positioned to secure a substantial share of the $42.45 billion in funding. Historical data and industry analyses suggest that fiber-optic infrastructure, favored for its reliability and scalability, could account for a significant portion of the allocations, with estimates indicating it could reach 70% to 90% of eligible locations depending on state priorities and cost thresholds. The program’s focus on connecting unserved and underserved areas, combined with the NTIA’s initial emphasis on fiber-to-the-premises, ensures that wireline providers will continue to play a central role, particularly in regions where terrain and population density support cost-effective fiber builds. While alternative technologies like fixed wireless and LEO satellites gain traction, the sheer scale of the funding and the long-term vision for robust, future-proof networks mean there is ample opportunity for fiber to thrive alongside other solutions.

Conclusion

The NTIA’s BEAD Restructuring Policy Notice is a transformative step toward ensuring that the $42.45 billion allocated for broadband deployment is used efficiently to connect unserved and underserved Americans. By adopting a technology-neutral approach and prioritizing cost-effective solutions, the policy removes barriers that previously favored fiber and opens significant opportunities for wireless technologies like FWA and LEO satellites. These technologies, with their ability to deploy rapidly and cost-effectively in challenging areas, are now well-positioned to secure a meaningful share of BEAD funding. The emphasis on competition and the “Benefit of the Bargain” ensures that taxpayers receive maximum value, while the inclusion of 5G and successor technologies signals a forward-looking approach to broadband infrastructure.

For the wireless industry, this is indeed a win, providing a chance to demonstrate the reliability and scalability of FWA and LEO solutions in areas where fiber is impractical. However, success will depend on providers’ ability to navigate the revised application process, meet technical requirements, and compete on cost. As Eligible Entities implement these changes, the BEAD Program is poised to accelerate broadband deployment, bringing high-speed internet to communities that have waited too long. The wireless industry, once sidelined, now has a seat at the table and a real shot at reshaping America’s broadband landscape.