Why Finding the Sweet Spot to Deploy Cell Sites Is Still Relevant

A Study in Situational Awareness by Bill Holick.

The Evolving Telecom Landscape

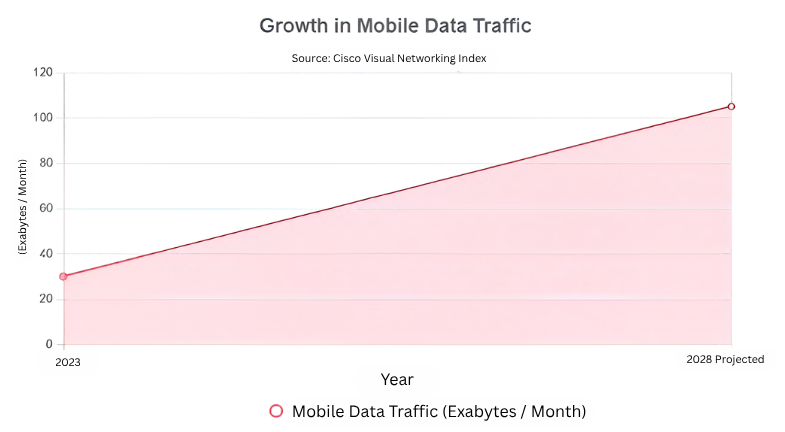

In today’s rapidly expanding digital ecosystem, situational awareness – the ability to understand exactly where cell coverage and capacity are most needed – has never been more essential. As U.S. mobile data traffic is projected to grow by 3.5x from 2023 to 2028 (Cisco VNI), identifying optimal tower locations is not just relevant, it’s mission-critical.

Urban Networks & the Return to Mobility

After several years defined by remote work, video calls, and home office connectivity, 2025 marks a turning point in the digital behavior of working Americans. Major corporations including Starbucks, AT&T, Target, JPMorgan Chase, 3M, and Goldman Sachs are rolling out return-to-office mandates, often requiring employees to be present three to five days a week. Law firms, tech giants, and public sector agencies are echoing this trend, citing the need for collaboration, accountability, mentorship, and organizational culture.

Stat: U.S. office occupancy rates reached 56.4% in early 2025, up from just 30% in 2021 (Kastle Systems Back-to-Work Barometer).

As this shift accelerates, so does the migration of data usage from residential Wi-Fi and fixed broadband networks back to mobility in urban environments. During the pandemic, most employees relied on fiber-to-the-home or residential Wi-Fi for Zoom calls, cloud apps, and VPN connections. Now, much of that demand is flowing through:

- Public 5G networks

- Enterprise small cell networks

- Edge computing deployments inside office clusters

Why Mobility Now Outpaces Fixed Connections

People are no longer sheltering-in-place and utilizing home offices. They are once again mobile, and a cellular network with ubiquitous cover is vital to meet that mobile demand. Unlike home offices where users typically remain stationary and close to a fixed Wi-Fi router, urban professionals are now on the move more frequently throughout the workday:

- Moving between buildings, transit hubs, and offsite meetings

- Attending conferences and events in stadiums, hotels, and public spaces

- Working from coffee shops, coworking spaces, and client locations without access to secure Wi-Fi

In these environments, users rely primarily on cellular connectivity, placing increased strain on macro networks and spotlighting the gaps in mobile coverage that weren’t visible during the work-from-home era. All this increased mobility will increase hand-offs from cellular point to cellular point, testing existing terrestrial networks. The solution will be more densification, i.e. more cell towers.

The Re-Rise of mmWave & Small Cells

To meet this renewed demand for low-latency, high-throughput mobile access, carriers are starting to go back to deploying millimeter wave (mmWave) small cells- compact, high-speed nodes capable of serving dense clusters of users in targeted areas. These are commonly mounted on:

- Streetlights

- Rooftops

- Bus shelters and transit signs

- Utility poles

However, identifying exactly where to place these small cells is a challenge. Demand isn’t uniform, it follows patterns of worker mobility, vehicular traffic, and footfall density that shift hour-by-hour and block-by-block.

Example: In New York City, the number of approved small cell sites has surged to over 5,000, a 78% increase since 2022- with many new permits clustered in Midtown, the Financial District, and Brooklyn Tech Triangle.

Why This Matters for Tower Companies & Municipalities

The return to urban mobility is not just a trend- it’s a long-term shift in data demand patterns. Carriers and infrastructure partners that can anticipate these patterns will lead the market in both performance and profitability.

That’s why platforms like Ambiflo’s Situational Awareness system are critical. By analyzing real-time human mobility data, zoning constraints, and existing signal performance, Ambiflo helps:

- Identify coverage blind spots

- Optimize small cell density

- Avoid overlapping infrastructure

- Reduce approval and permitting friction

Legislative Tailwinds: New Policy, New Demand

A major regulatory breakthrough has reshaped the trajectory of wireless infrastructure in the United States. With the passage of the bipartisan “One Big Beautiful Bill”, the Federal Communications Commission (FCC) regained its spectrum auction authority, a power that had lapsed in 2022. This authority enables the FCC to release more licensed airwaves to commercial carriers and private operators, fueling a new wave of network expansion and tower construction across the country.

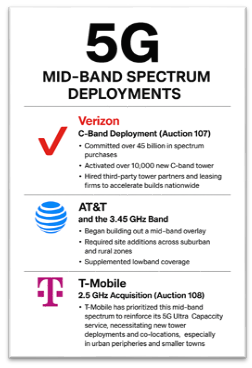

At the heart of this expansion is the unlocking of valuable mid-band spectrum, including:

- 3.45–3.55 GHz (Auction 110)

- 3.7–3.98 GHz C-band (Auction 107)

- Upcoming 12 GHz and 42 GHz bands (planned for Auction 112 and beyond)

These frequencies strike the ideal balance between coverage and capacity, making them especially suitable for 5G deployment via macro towers and small cells.

Stat: Over 95,000 mid-band 5G base stations are projected to be deployed across the U.S. by 2026 (CTIA), with each base station typically requiring new or upgraded tower infrastructure.

How Spectrum Auctions Drive Tower Development

Every newly auctioned spectrum band introduces new radio requirements, which often cannot be met with existing infrastructure alone. Mid-band and high-band frequencies (such as mmWave) have shorter propagation distances and higher capacity demands, prompting carriers to:

- Densify their networks with more cell sites

- Upgrade tower equipment (antennas, radios, and power)

- Deploy new macro towers in previously underserved or interference-heavy areas

Real-World Examples & Effects

FCC Commissioner Brendan Carr: An Infrastructure Champion

Commissioner Brendan Carr has emerged as one of the strongest voices for tower deployment and 5G investment. Known for literally climbing towers to spotlight industry needs, Carr has led the charge in:

- Streamlining federal and local permitting

- Advocating for “shot clocks” to accelerate municipal siting decisions

- Cutting red tape related to environmental and historic reviews

His efforts have already helped reduce permitting times by up to 50% in some markets, giving carriers a faster path from auction to activation.

“To win the race to 5G, we need to win the race to build.” — FCC Chair Brendan Carr

What New Auctions Will Mean

The return of FCC auction authority unlocks new potential for:

- Private 5G networks for enterprise, manufacturing, and utilities

- Neutral-host small cell networks in dense venues like stadiums and airports

- Rural macro towers built to serve BEAD-aligned fixed wireless solutions

As more spectrum becomes available, demand will rise not only for more towers, but also for smarter siting tools like Ambiflo’s Situational Awareness platform, which helps determine where spectrum can be best monetized and deployed with maximum efficiency.

BEAD and the Rural Tower Boom: Fixed Wireless Access Gains Momentum

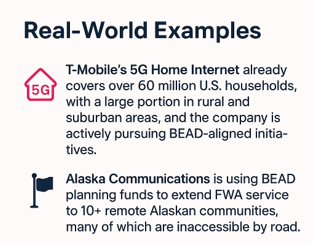

The $42.45 billion Broadband Equity, Access, and Deployment (BEAD) program is driving a new era of non-fiber broadband strategies, especially in rural, remote, and Tribal communities where laying fiber is often prohibitively expensive or technically unfeasible. Among these alternatives, Fixed Wireless Access (FWA) has emerged as a cost-effective, rapidly deployable solution, helping states close the digital divide without waiting years for traditional infrastructure builds.

Unlike fiber, which requires digging, trenching, and extensive permitting, FWA relies on radio signals transmitted from strategically located macro towers or small cells, which connect to customer premises equipment (CPE) such as rooftop receivers or indoor gateways. These systems can deliver download speeds exceeding 100 Mbps, meeting or surpassing BEAD’s performance thresholds, particularly in areas with sparse population density.

Why FWA Works for BEAD Projects

- Speed to Deploy: Tower-based FWA networks can be rolled out in weeks instead of years, allowing broadband providers to meet BEAD grant timelines efficiently.

- Cost Advantage: According to a study by Deloitte, the cost of deploying fiber in rural areas can reach $8,000–$10,000 per home, while FWA deployments are typically 70% less expensive.

- Scalable Performance: With spectrum in the CBRS, C-band, and millimeter wave ranges now available, FWA can scale with user demand and meet high-capacity use cases, such as telehealth and distance learning.

Strategic Implications for Tower Development

This shift is triggering a rural tower boom, with providers increasingly turning to build-to-suit tower developers and site acquisition experts to place assets where terrain, demand, and backhaul availability align. Ambiflo’s Situational Awareness solutions are already helping stakeholders identify the optimal sites for FWA coverage, ensuring that every tower built under BEAD funding delivers maximum ROI and broadband impact.

As states finalize their Initial Proposals and Challenge Processes in 2025, expect to see FWA solutions playing a front-line role in state-level broadband strategies, cementing their place as the infrastructure of choice for connecting the last unserved mile.

Precision Deployment: The Ambiflo Edge

In today’s fast-evolving telecom landscape, where you build is just as important as what you build. As deployment costs soar, spectrum becomes more fragmented, and urban permitting gets more complex, finding the true sweet spot for tower siting is no longer something traditional methods can handle alone. Maps, permits, and basic RF planning are not enough. Operators need actionable, location-specific intelligence, and that’s exactly what Ambiflo’s Situational Awareness platform delivers.

Why Ambiflo Sets a New Standard in Site Intelligence

Ambiflo’s platform is not just another planning tool, it’s a next-generation decision engine, combining probabilistic geo-statistical modeling, AI-enhanced cluster analysis, and multi-layer data fusion to help stakeholders make confident, capital-efficient deployment decisions.

With Ambiflo, carriers, tower developers, and broadband agencies can:

- Model real-world signal strength based on elevation, land cover, and clutter variables- ensuring you don’t just “see” a location but understand its actual coverage potential

- Overlay hyperlocal demographic, economic, and mobility data to prioritize high-demand, underserved areas

- Assess permitting risk at the parcel level by integrating zoning ordinances, municipal timelines, and public feedback trends

- Measure pole space competition and lease costs to predict deployment friction points and budget more accurately

- Simulate multiple deployment scenarios—rural, urban, and hybrid—to find the option with the best ROI, speed to deploy, and long-term scalability

What Makes the “Sweet Spot” So Hard to Find?

The “sweet spot” for a tower is a balancing act of coverage, capacity, and compliance:

- A tower that’s too far from demand won’t generate ROI.

- A tower in the wrong terrain won’t meet coverage targets.

- A tower that’s easy to build—but poorly placed—creates downstream congestion and churn.

Ambiflo helps solve all three challenges at once, by integrating:

- Crowdsourced usage data for real-time demand modeling

- Competition scoring to avoid oversaturated areas

- AI-driven prioritization to fast-track the best locations from thousands of potential candidates

- Regulatory overlays to avoid delays from zoning issues

Conclusion: Smarter Siting Is Strategic Siting

Whether it’s a 300-foot macro tower in rural Oklahoma or a mmWave small cell on a lamppost in Midtown Manhattan, the right site still determines 80% of deployment success. In an industry where delays mean lost spectrum value and missed subscriber growth, precision is power.

Ambiflo’s Situational Awareness system offers clarity in complexity, making it the industry’s most advanced tool for site selection, planning, and deployment. For carriers, towercos, neutral hosts, and public broadband authorities alike, Ambiflo delivers faster builds, lower costs, and better coverage, every time.

📬 For more information, visit ambiflo.com or email [email protected]

🔗 Follow on LinkedIn: Ambiflo